Credit is a Silly Game

Credit is a game that if played incorrectly, will keep you on the poverty side of the line more often than not. It’s easy to make mistakes too – miss one payment and suddenly interest rates are up, no new loans are available and you are a cash only buyer. That is a slight exaggeration, but not by much!

Your Credit Score

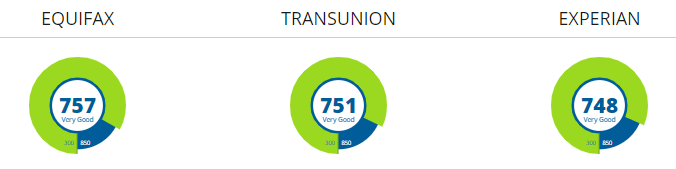

Your “score” of how well you play the game is kept by 3 companies: Transunion, Equifax and Experian. They all score you differently and a lender can ask one or more of these companies for a report about you. Scores range from low 400’s to 900 and lenders treat you vastly different for even a 25 point difference. Therefore, it’s important to understand how to get the best score possible. The scores are free after all – you only need play the game.

Main Factors of Credit Score

- Paid on Time

- Credit Usage

- Age of Accounts

- Mix of Accounts

- Inquiries

- Recent Credit

- When you are 30, 60, 90 or more days late you are penalized, pretty much forever. The effect lessons as time goes on (2 years seems to not matter very much), but it’s still in your file. Whatever you do, do NOT go 30 days late or more! This factor is about 35% of your score, the most significant, so ALWAYS pay on time.

- If you ever use your cards, you are penalized, but not quite. What does that mean? It’s a catch 22. You MUST use your cards to keep them active. However, if you use your cards too much and keep a balance on them, your score will drop. 5% usage or more will hurt your score. Not using them for 3-6 months will get your account closed, which hurts even more! The secret is to pay them off immediately if you are using more than 5% of the limit. So if you have $100 limit, you cannot keep more than $5 on credit. 10000 limit? You cannot keep more than $500 on the card without penalty. When you reach 30% or more, your score can drop as much as 50 points! This factor is about 30% of your score.

- There are some tricks to this, but the best thing is to simply have credit accounts that are old. Open them as soon as you can and just keep using them (like above). Every year or so you move to a new tier. This factor is about 15% of your total score.

- When you have a mortgage, car loan, credit cards, signature loans, secured loans, and more – you get the maximum score in this category. Choosing which types of loans/credit can help you get the best possible score. This category is only 10% or so.

- When you ask for money, lenders scoff at you. No really! The more you ask they more they detest you. They prove this to you by lowering your credit a few points each time. The most they can lower your score is by 10% of the total score. So if you have a 700 score, the most it will drop by asking is 70 points. Ideally you want to keep asking for credit even though this penalty is maxed. In reality you will be denied credit unless you space out your requests by 3-6 months.

- Even with perfect credit you can be denied new credit. Lenders do not like to give you credit if you just received new credit. I find that every 4 months or so, I can get another few lines of credit. This means I just wait 4 months, then ask again to get new credit. This doesn’t really drop your score, but it’s a hard limit that many lenders will simply deny.

How to Win the Credit Game

Knowing the ins and the outs of the game are difficult. We have a free report that will walk you through some of the most common traps and give you powerful tips.